42+ why isn't my mortgage interest deductible

Box 1 Interest paid not including points. You paid 4800 in.

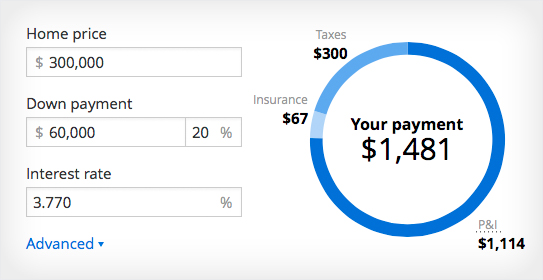

Mortgage Calculator Free House Payment Estimate Zillow

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

. The terms of the loan are the same as for other 20-year loans offered in your area. So if you have. 18000 for heads of household.

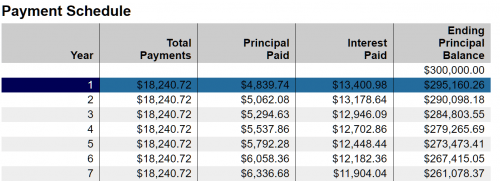

Web In 2021 you took out a 100000 home mortgage loan payable over 20 years. Web Used to buy build or improve your main or second home and. Box 3 Mortgage origination date.

Go to Forms menu - on the top right corner of the. Thus if you pay interest on a 250000 mortgage all of it. Web IRS Publication 936.

Web On your 1098 tax form is the following information. Box 2 Outstanding mortgage principle. Web I had the same issue with turbotax not allowing to deduct a 31K mortgage interest.

You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt. The work around is rather simple. Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year.

Secured by that home. Web The IRS places several limits on the amount of interest that you can deduct each year. Web You can deduct all of your mortgage interest on up to 1 million in principal on the home in which you live.

For tax years before 2018 the interest paid on up to 1 million of acquisition. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately.

Web For tax years 2018 to 2025 the standard deduction has been increased to 12000 for singles and married filing separately.

Is My Mortgage Interest Still Tax Deductible The Henry Levy Group A Cpa Firm

Mortgage Interest Deduction How It Calculate Tax Savings

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

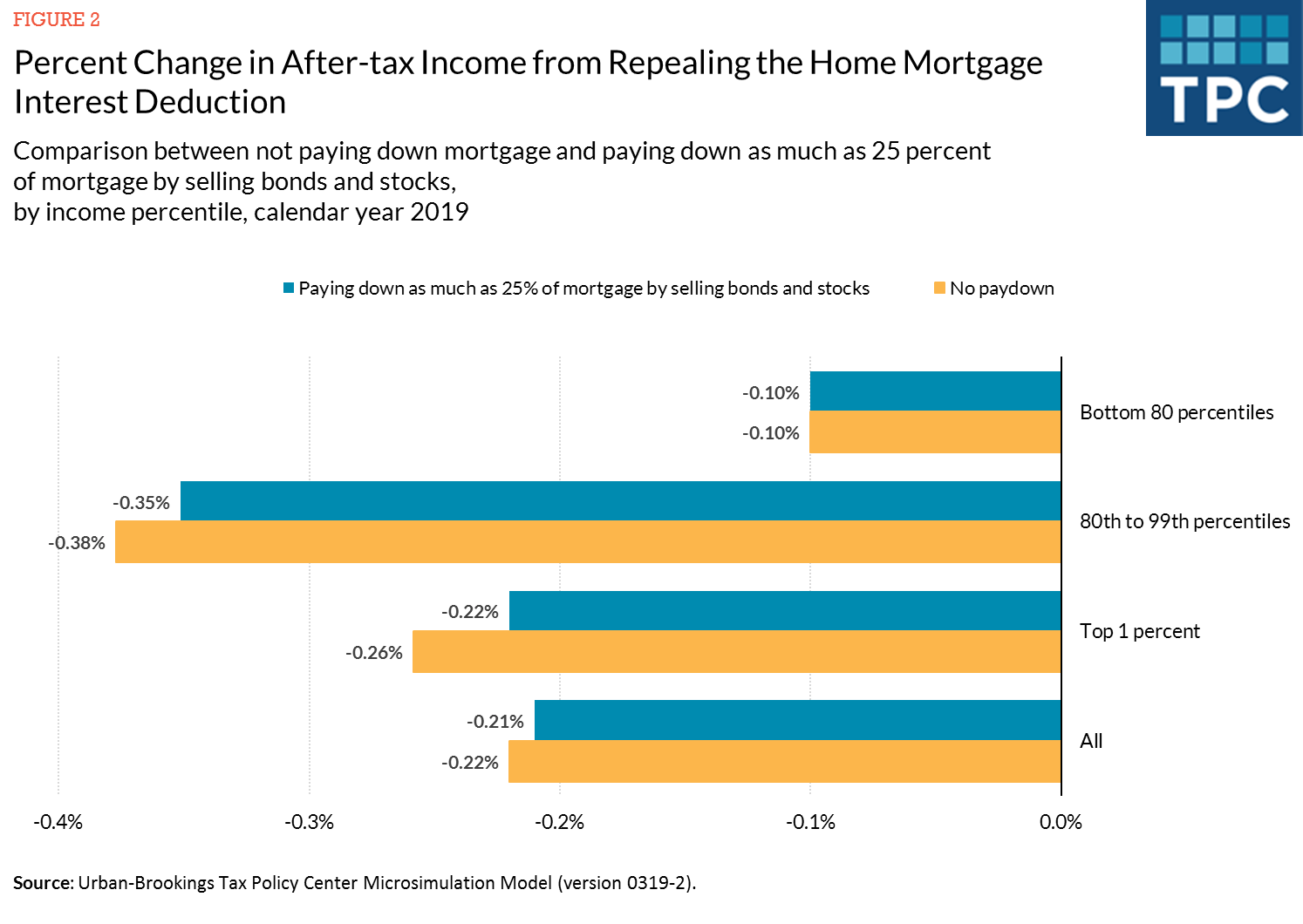

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

What Is Mortgage Interest Deduction Zillow

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

![]()

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Maximum Mortgage Tax Deduction Benefit Depends On Income

Keep The Mortgage For The Home Mortgage Interest Deduction

Mortgage Interest Deduction How It Works In 2022 Wsj

Savage 110511 By Big Fish Works Issuu

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Mortgage Interest Deduction How It Works In 2022 Wsj

Mortgage Interest Deduction Save When Filing Your Taxes

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year