Mortgage calculator with taxes and escrow

The other portion is the interest which is the cost paid to the lender for using the money. There may be an escrow account involved to cover the cost of.

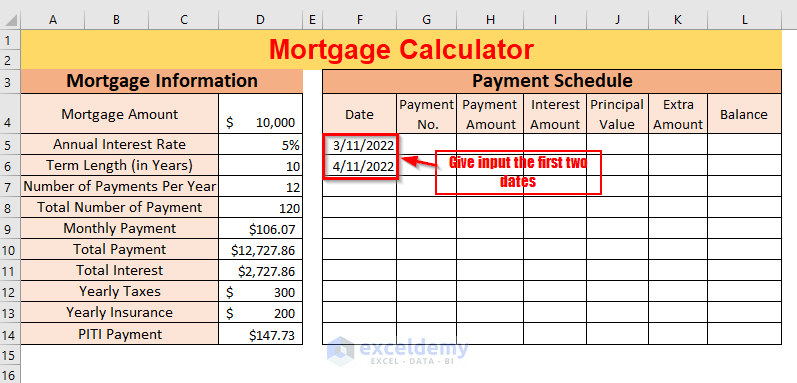

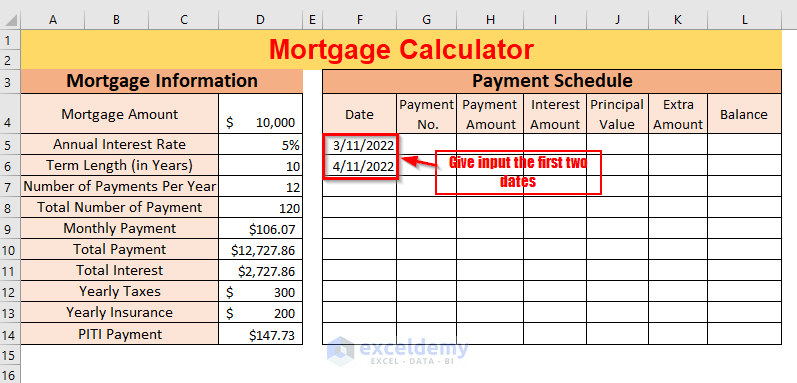

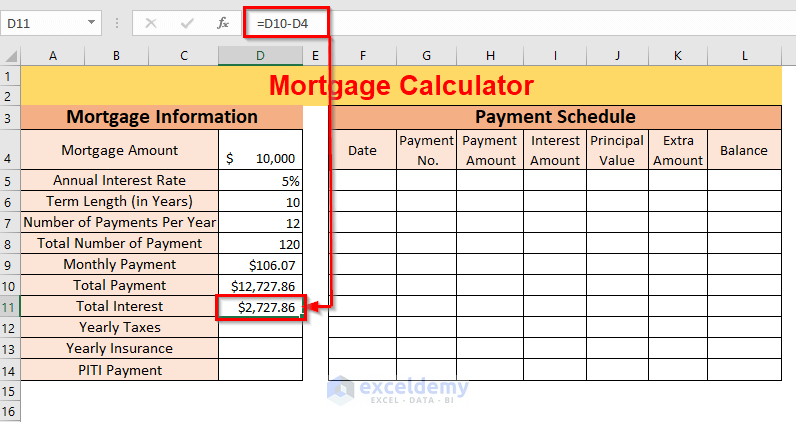

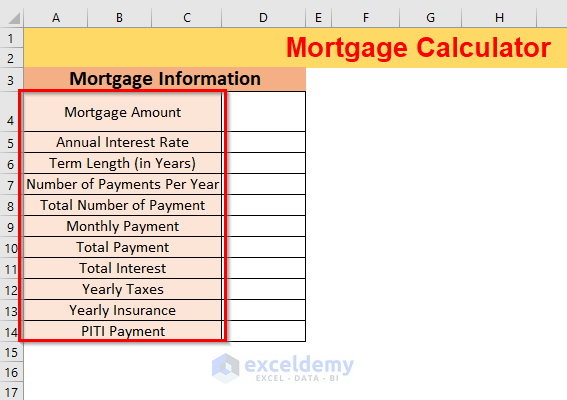

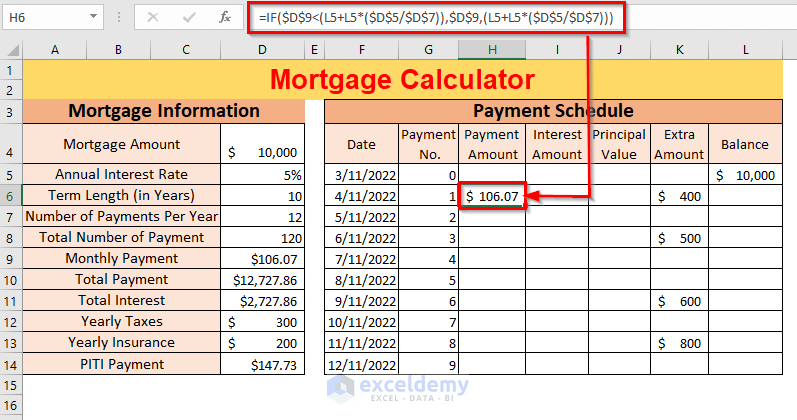

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

Our calculator includes amoritization tables bi-weekly savings.

. Use this free California Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. While private lenders who offer conventional loans are usually not required to do that the FHA requires all of its borrowers to pay taxes along with their monthly mortgage payments. The calculators results page will return a loan option best fit for your needs including the length projected rates.

However some lenders have. To include annual insurance and taxes in your calculations use this mortgage calculator with taxes and insurance. Some may even require it.

This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. Paying Taxes With a Mortgage. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based.

Using the United States Tax Calculator. This is a good estimate. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

First enter your Gross Salary amount where shown. This portion goes into the lenders pocketIts their fee for lending you the money. How to Use the Mortgage Calculator.

Youll likely have the option of paying your property taxes from an escrow account. Principal and interest account for the majority of your mortgage payment which may also include escrow payments for property taxes homeowners insurance mortgage insurance and other costs. Check out the webs best free mortgage calculator to save money on your home loan today.

Most lenders allow you to pay for your yearly property taxes when you make your monthly mortgage payment. Most low-down mortgages require a down payment of between 3 - 5 of the property value. Homeowners who have experienced a financial hardship who took out a mortgage on or before January 1 2009.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and. The Rocket Mortgage calculator takes those taxes into consideration when giving you an estimated monthly mortgage payment. When keeping taxes and insurance in an escrow account the payment charged by your financial institution could be different.

The Loan term is the period of time during which a loan must be repaid. Use this PITI calculator to calculate your estimated mortgage payment. Your estimated yearly payment is broken down into a monthly amount which is stored in an escrow account.

See how changes affect your monthly payment. If you are filing taxes and are married you have the option to file your taxes along with your partner. Homeowners must have mortgage loans insured by CalHFA Mortgage Insurance on or before May 31 2009.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Mortgage Amount the original principal amount of your mortgage when calculating a new mortgage or the current principal owed when calculating a current mortgage Mortgage Term the original term of your mortgage or the time left when. To determine how much property tax you pay each month lenders.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. The interest is the cost of borrowing the principal.

Lenders often roll property taxes into borrowers monthly mortgage bills. Most people need a mortgage to finance a home purchase. Your lender then pays your taxes on your behalf at the end of the year.

CalHFA Mortgage Insurance Services HARP Eligible Program. This portion goes toward paying down your mortgage balancethe original amount you borrowed. You can also select to see how the principal and interest change over time in a bar chart select the.

Lowers monthly mortgage payments so that theyre more affordable. Home financial. Mortgage programs which require a minimal down payment.

Our mortgage calculator can help you determine what mortgage you can afford by taking simple information about your finances and prospective home to predict your monthly payments including your principal and interest rate. Next select the Filing Status drop down menu and choose which option applies to you. It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization.

This goes into a holding fund an escrow account that your lender or mortgage servicer uses to pay your property taxes and homeowners insurance. Use this mortgage calculator to estimate how much house you can afford. Like homeowners insurance property taxes can vary significantly depending on where you live.

When calculating a new mortgage where you know approximately your annual taxes and insurance this calculator will show you the monthly breakdown and total. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. PITI is an acronym that stands for principal interest taxes and insuranceAfter inputting the cost of.

The chart shows how much of your monthly loan payment will be applied to principal and interest mortgage insurance and taxes and homeowners insurance. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. Using the United States Tax Calculator is fairly simple.

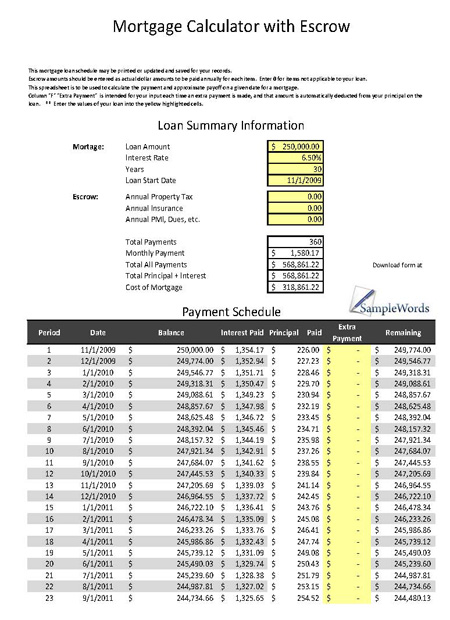

For example a 30-year fixed-rate loan has a term of 30 years. This Excel spreadsheet is an all-in-one home mortgage calculatorIt lets you analyze a fixed or variable rate home mortgage. See your total mortgage payment including taxes insurance and PMI.

You can set up periodic extra payments or add additional payments manually within the Payment ScheduleUse the spreadsheet to compare different term lengths rates loan amounts and the savings from making extra. The principal is the amount of money being borrowed also called the loan amount.

Mortgage Calculator With Taxes And Insurance

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments Mortgage Loan Calculator Mortgage Amortization Calculator Amortization Schedule

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

Mortgage Calculator Estimate Your Monthly Payments

Mortgage Repayment Calculator

Interest Only Mortgage Calculator

Mortgage Calculator How Much Monthly Payments Will Cost

Downloadable Free Mortgage Calculator Tool

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments Mortgage Payment Calculator Mortgage Calculator Mortgage

Mortgage Calculator

Pin On Real Estate

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

The Mortgage Center Financial Calculators Com

Mortgage Calculator With Escrow Excel Spreadsheet